Two statistical tidbits from a recent post from Jason Notte about the proliferation of SKU’s (aka stock keeping units)

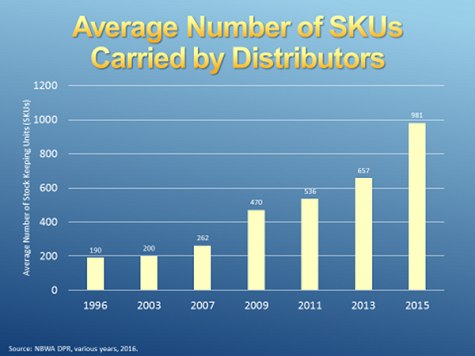

“Meanwhile, it’s starting to tax the people who have to bring that beer to retailers. Independent beer distributors were carrying an average of just 262 SKUs in 2007, according to the National Beer Wholesalers Association’s 2015 Distributor Productivity Report. Just last year, those same distributors were dealing with an average of 981, with a reported range between 600 to more than 1,600. They’re also dealing with an average of 35 breweries, compared with just nine two decades ago.”

Imagine that you are selling beer, or delivering beer or hell, being the data entry specialist at a distributor now? You are juggling a lot of balls now. You now should really know 35 breweries and their offerings where before you had to only keep 9 straight. There are multiple variants of multiple beers. And if you are in Los Angeles, you need to know the day-to-day traffic patterns too just to physically get a beer on a shelf to be bought. Then (if you are on the ball), you have to police retailers and get old product off the shelves in a timely manner.) The spreadsheets and customized computer programs would be mind boggling to the average beer drinking person.

“The burden of that increased SKU count isn’t just on distributors and stores. While the beer industry’s SKU count has increased 244% since 2008, total U.S. beer output has actually dropped 3.3% during that same span — from 213.3 million barrels to 206.3 million. While it’s true that craft beer’s production has nearly tripled in that time — from 8.4 million barrels to 22.2 million in 2014 — and its brewery count has soared from 1,500 to more than 4,000, there’s a catch.”

This stat is fun. Couple layers to peel. Back before craft (BC), it was a large amount of beer and little SKU numbers. Now that beer amount is down but there are now more breweries in the US than ever before. But nesting in that number is that the growth category of craft is well dominated by the major players of the Top20 list. So bigbig has fallen backwards but littlebig has grown. The intimation being that littlebig may well be on the way to being bigbig and how will they behave towards the little?