How’s this for beer business water cooler talk…

“Sapporo U.S.A., maker of the number one selling Asian beer brand in the United States, and Stone Brewing, one of America’s largest and most innovative craft beer brands, have reached an agreement for Sapporo U.S.A. to acquire Stone Brewing. Supporting both business’ long-term growth strategies in the U.S. market, the transaction is expected to close in August 2022. “

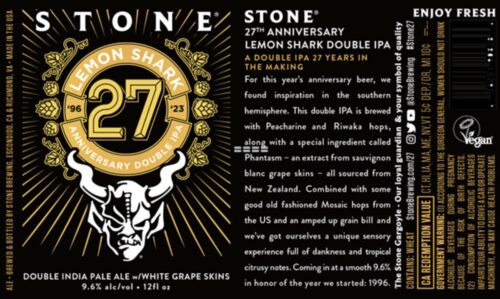

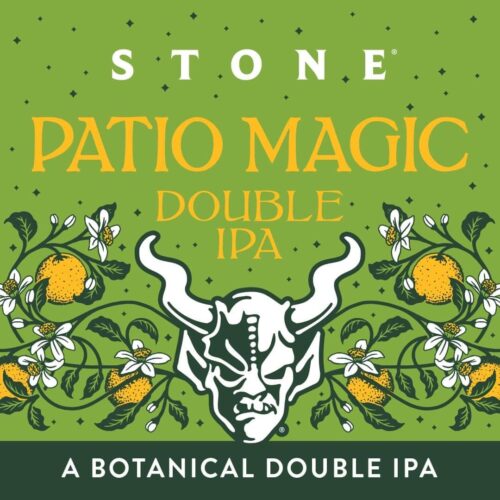

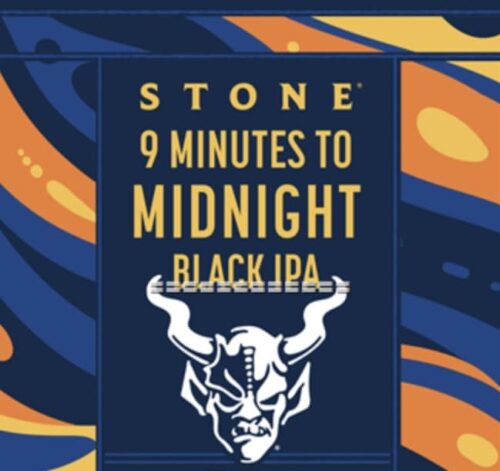

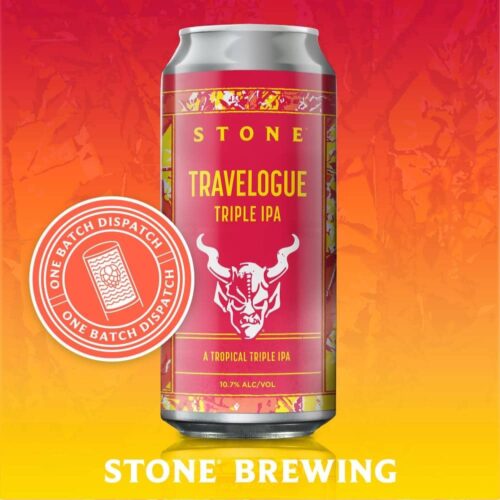

Could this work? Sapporo already controls Anchor and aside from can label designs that are a little plain, seem to be in the same craft brewing pecking order as they were before. But though Stone has slipped into seltzers and brand extending Buenaveza lagers, it is still primarily a hop house something Sapporo is decidedly not.

Sapporo does seem to have a California heritage brewery soft spot. Stone is a world brand despite the pullback from Berlin and having both a West Coast and East Coast brewing operation has benefits. Though if I signed on to brew at Stone and I was suddenly making Sapporo for a living, it might be stunting creatively.

For some, the past bold statements from Greg Koch and initiatives to keep craft independent will be “flip flop” fodder for semi-humorous tweets but to me…

The big question that I fall back to is that despite the relative security of a stable parent company, what happens if Stone doesn’t generate money at the clip required. What happens then? Or what if Sapporo decides five years down the road that they want out of a hyper competitive California and U.S. beer market?

As with Anchor Brewing, only time will tell if the two can work together. Maybe Sapporo, Stone and Anchor can do a Hoppy Holiday lager for Christmas.